Over the last five years there has been, and to an extent continues to be, plenty of hype about what 5G will do. Driverless cars, remote surgery, the metaverse — all buzzwords that have yet to materialize in any real way.

One area where it has noticeably helped change our lives? It finally provides some long-overdue competition to cable companies for home broadband. I’ve been exploring whether 5G and technologies like it (known as “fixed wireless”) could replace traditional home broadband over the past year, testing out midband solutions from Verizon and T-Mobile, as well as millimeter-wave options like Honest Networks .

I ditched my Spectrum subscription and even switched my apartment to Honest, which provides gigabit upload and download speeds to our building for $50 per month. It was great for months, and I would’ve been happy to continue using it.

At least, until Spectrum came knocking.

Competition breeds deals

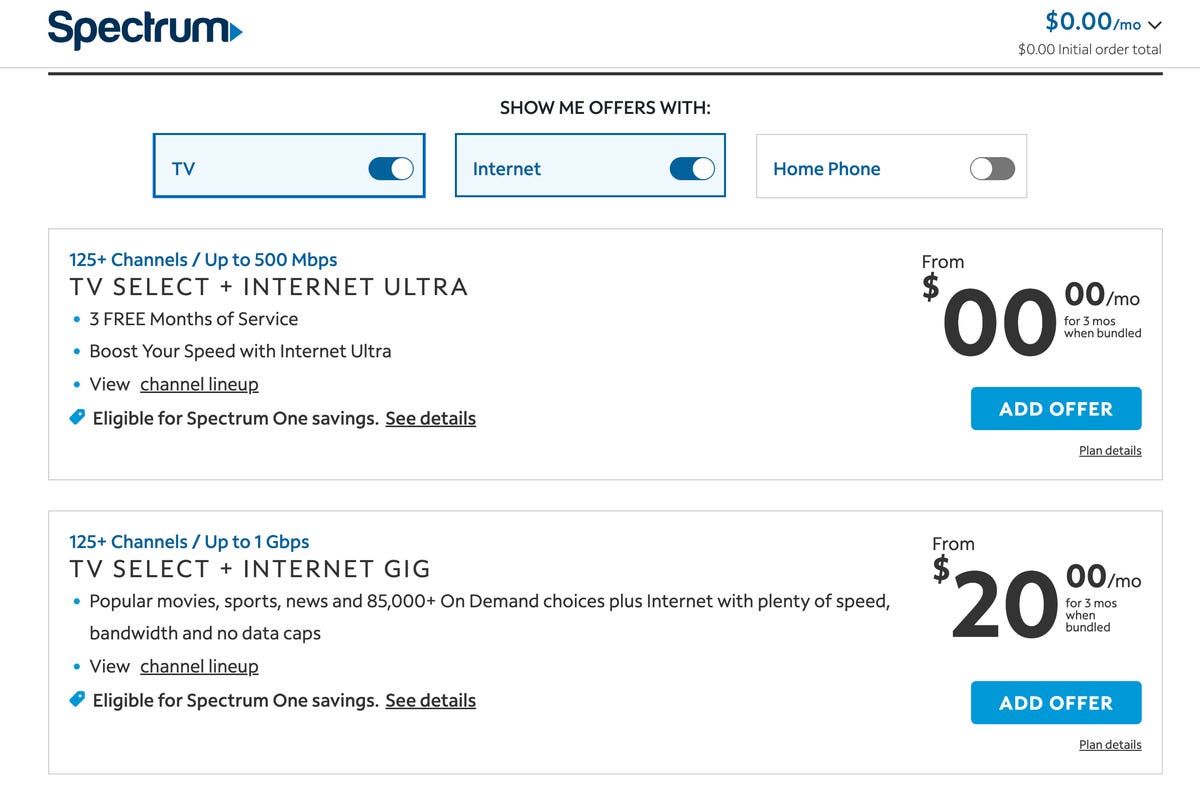

Spectrum’s deal of three months free was awfully compelling.

Screenshots by Eli Blumenthal/CNET

Since ditching Spectrum I got a flyer in the mail offering three months of free TV and internet if I switched back. There were no contracts or commitment strings attached either. The company seems to be hoping that once people sign up, they won’t leave again so quickly.

As an avid sports fan, the appeal of traditional cable was certainly enticing for the rest of the NFL and college football regular seasons, MLB postseason and the beginning of the NBA and NHL campaigns. Getting and managing regional sports networks in New York is a hassle, and the only streaming service that offers all of them (DirectTV Stream) is pricey at $90 per month for the Choice package.

While my internet speeds wouldn’t be as fast as the gigabit promised by Honest, Spectrum’s Internet Ultra offers download speeds “up to 500Mbps” which is more than enough for all of my and my roommates’ work, video chats, streaming and gaming.

Plus, even after the three months are up, the internet charge would be $40 per month, a $10 monthly savings compared to T-Mobile and Honest.

I can’t say this deal is a direct result of 5G internet options joining the fray and adding competition. I also don’t know if Spectrum is offering this everywhere or just in some markets like New York City, but it does seem to be a newer option.

“We have nationally consistent regular pricing and customer-friendly policies like no modem fees, data caps or contracts,” a Spectrum spokesman said in a statement. “We often offer promotions to new or upgrading customers to give them the chance to sample a service or package at a discount, for a specific period of time, before the regular price takes effect.”

These deals also aren’t always just for new subscribers. The old trick of calling up your provider and threatening to switch to T-Mobile or Verizon, which I noticed when helping a friend with their Optimum bill in New Jersey, helped lower their bill by $40 per month before they adjusted anything on their service.

The cable companies seem to be concerned, and perhaps rightfully so. Verizon’s earnings saw consumers flee its traditional wireless phone business amid higher prices, but the carrier did add 234,000 consumer “fixed wireless” users.

T-Mobile added 578,000 home internet users in its most recent quarter and now has over 2.1 million subscribers.

Comcast, the largest cable operator in the US, seems to be particularly worried and earlier this month began rolling out TV ads against T-Mobile’s Home Internetencouraging users to head to its website where it “compares” the two broadband options. A number of cable companies — including Comcast, Optimum and Spectrum — have also been offering bundles of home internet with their own mobile services.

“I think you’ll see (cable companies) getting more aggressive with promotions and work on driving up speeds to try and counter the momentum the telcos are getting,” Technalysis Research analyst Bob O’Donnell says.

“Given how fast (home internet) subscribers for both T-Mobile and Verizon have been growing, consumers clearly get it and seem eager to move away from cable companies,” he says.

Faster speeds are coming, too

Getty Images

Beyond the price and deals, the rise of 5G home broadband has also coincided with a renewed push by cable companies on speed. Comcast’s lead point against T-Mobile is that it has more gigabit offerings available and that its broadband could be up to 36 times faster than T-Mobile’s 5G home internet.

“Fixed wireless over 5G is making it crucial that cable companies upgrade their infrastructure to be able to claim consistently high speeds, particularly on uploads where wireless can struggle today,” said Avi Greengart, an analyst for research firm Techsponential.

A wide variety of other providers including Optimum, Spectrum, Verizon and AT&T have added new multigigabit speed tiers and expanded their buildouts for fiber service, all while the three major wireless providers continue to build out and improve 5G service. This push for faster options should allow for not only the prospect of better speeds for those looking for a boost but also better selections for their needs.

“People who are continuing to work at home or who just want the fastest option will look at fiber,” says O’Donnell. “Mainstream users now have multiple choices and folks who have had limited options (rural, etc.) now can finally get something reasonable.”