‘Me too’ investing is eating returns TechCrunch

For an asset class that should be reinventing itself all the time, it is surprising to see how resistant some venture funds are to change.

As a partner in a fund of funds, I attend a lot of annual meetings, talk with a lot of venture fund general partners and review a lot of investor decks.

What has particularly surprised me is how many funds tell exactly the same story and invest in exactly the same areas: B2B SaaS, cybersecurity, cloud infrastructure tech, e-commerce brands and crypto/fintech.

As I have written many times before, venture is about elephant hunting. Great funds have at least one, and ideally a few, enormously successful, fund-returning investments. Ownership and letting the great companies “ride” (and not selling them early) is crucial to getting outsized returns.

But, the outsized returns only come from companies that are market leaders in enormous markets. The second-place company, and sometimes, the third-place company can win, too, but of course will not be as large. But the companies that end up at #300 or #99 or even #20 in a market do not end up as good investments.

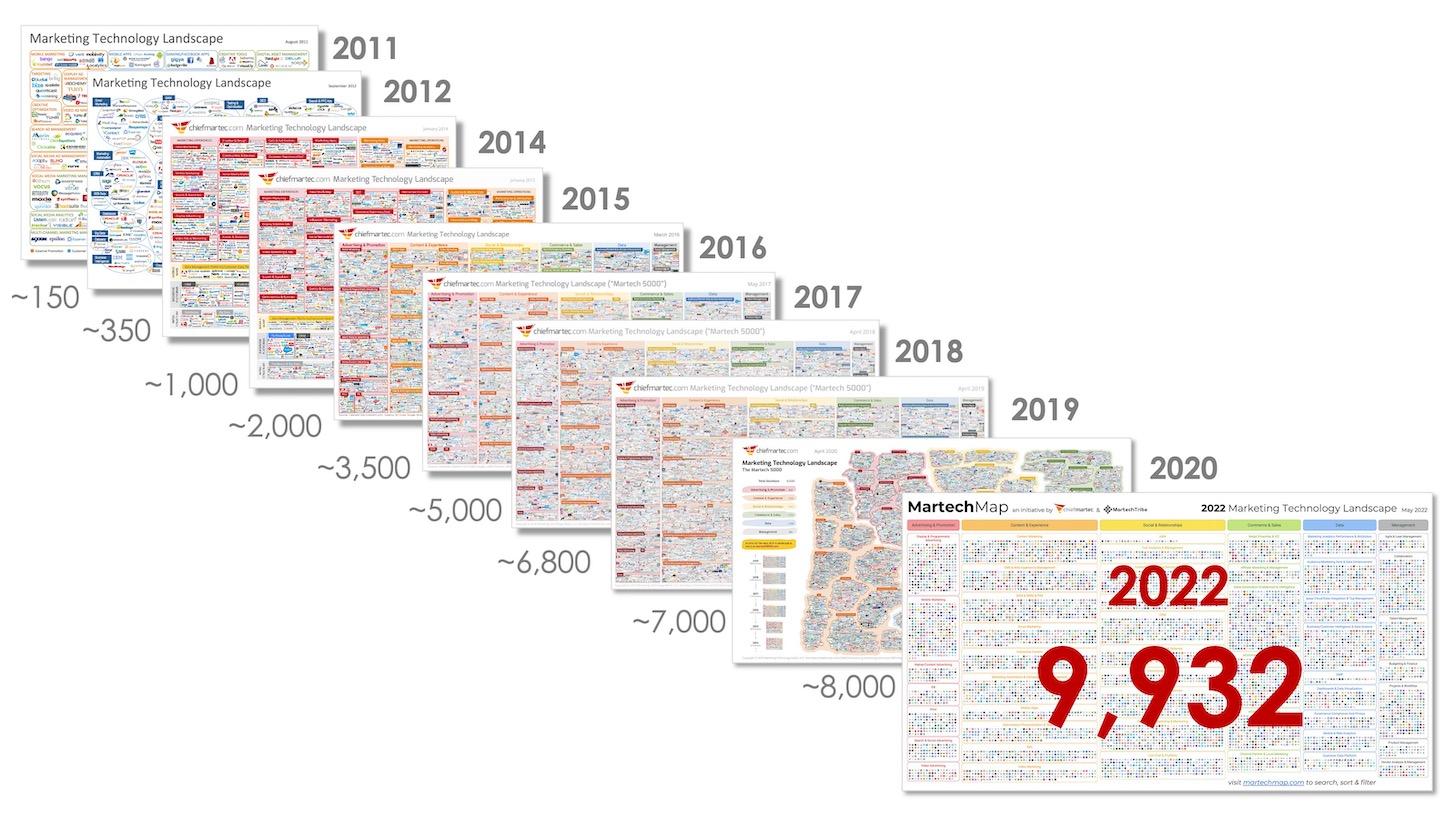

I was thinking about this recently when I looked at a map of martech SaaS companies that chiefmartec and MartechTribe prepared recently. What is amazing is how many marketing SaaS companies still get funded:

Image Credits: Scott Brinker of chiefmartec and MartechTribe

While not nearly as bad as marketing tech, we are seeing a huge inflation in the number of cybersecurity and