Google’s new Pixel 7 and Pixel 7 Pro promise to be impressive phones that could rival Apple’s iPhone 14 and Samsung’s Galaxy S22, all while undercutting Apple and Samsung on price. Even with noteworthy software and camera features, Google made a particular point to emphasize this during Thursday’s Pixel event. The Pixel 7 starts at $599 (£599, AU$999) while the 7 Pro starts at $899 (£849, AU$1,299).

By contrast, the Samsung charges $799 for the S22 (or $1,200 for the S22 Ultra). Apple, henceforth, prices the iPhone 14 at $799 and the 14 Pro Max at $1,099. Unfortunately for Google, this price difference may not actually matter to the US audience where consumers still largely buy devices from wireless carriers.

When going this route, the price difference melts away as all three of the major providers offer a variety of trade-in and upgrade deals on iPhones, Galaxies, Pixels and other devices to both new and existing users. At Verizon, for example, depending on your plan and trade-in device (and your willingness to stay with the carrier for 36 months) you could get an iPhone 14 Pro or iPhone 14, Galaxy S22 or Galaxy S22 Plus for free. Devices like the iPhone 14 Pro Max, Galaxy S22 Ultra or Z Fold 4 could be had for up to $1,000 off. AT&T and T-Mobile regularly offer similar deals.

For the carriers, subsidizing the price of a device is a good way to lock users into 24- to 36-month financing plans and make it more complicated to switch to a rival. It’s also a good way to get people to switch to newer, sometimes pricier monthly unlimited plans. While all three providers have plenty of deals on the new Pixelsthey offer similar discounts for Apple and Samsung phones that make the price difference Google is highlighting less of an issue.

According to Roger Entner, an analyst at Recon Analytics, 75% of people in the US upgrading to a new phone during the June-through-September period did so with financing on an installment plan.

“People in the US largely fall into two categories. Flagship phone buyers who want all the bells and whistles and budget buyers for [whom] price is the most important,” Entner tells CNET. He adds that while the Pixels are “a little bit cheaper than the iPhone” it won’t be “enough to really notice if you finance” and will only play a role if you are paying out of pocket for the phones.

Still playing a long game at home and abroad

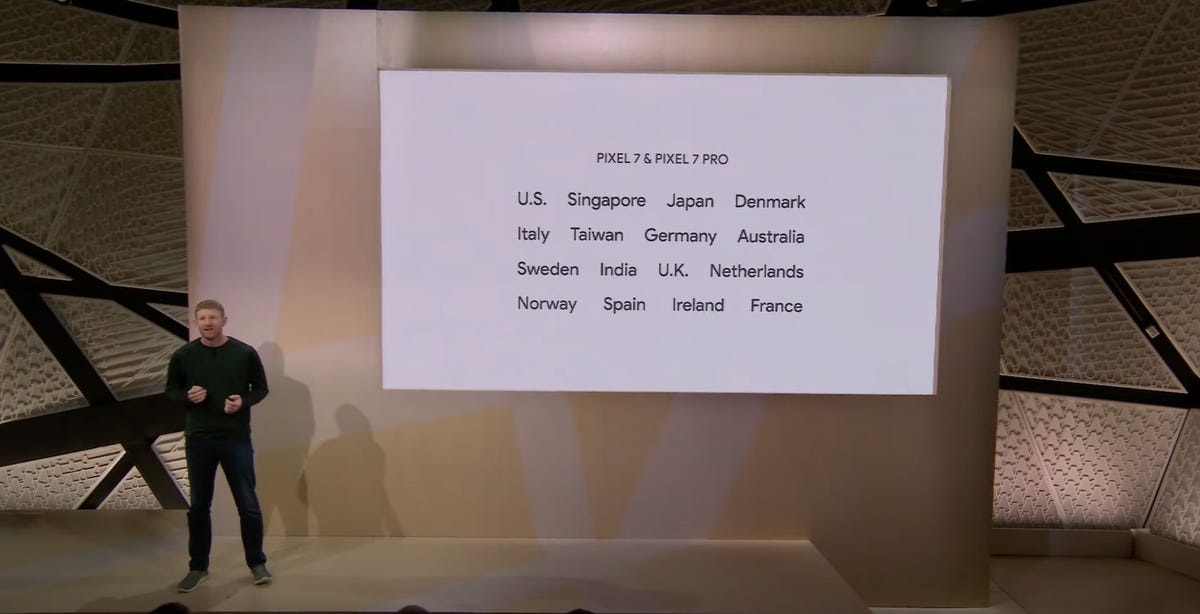

Google is expanding the Pixel’s availability with the 7 and 7 Pro.

Screenshots by Eli Blumenthal/CNET

After years of working on building up the Pixel brand as an alternative to Apple and Samsung, Google still doesn’t have much to show for it. A recent report from Canalys that evaluated the market during the second quarter of 2022 saw the company grow by 230% annually, but even with that growth it still tallied just a 2% market share in North America.

“I do think the more aggressive pricing will help Google,” says Bob O’Donnell, president and chief analyst at Technalysis Research. “But given the tiny market share size they have, even if they double it, it would only prove to be incremental.”

One area where Google could benefit from a lower price, however, is overseas. The company is expanding the Pixel’s availability with the new 7 and 7 Pro and will be selling the devices in 16 countries.

“I do think it gives them more opportunities internationally as well,” O’Donnell adds, noting that if Google “can start to get traction, it gives them momentum moving forward. That’s probably as important to them as anything.”

Avi Greengart, an analyst with Techsponential, agrees. “The bigger news is that Google is expanding its sales footprint to new markets, making the Pixel line less of a US phenomenon, and more globally accessible.”